Personal Finance, like most important aspects of life, is a never-ending quest, the competent investor never stops learning. - William J. Bernstein

In this inaugural edition of Medals and Ribbons, we present an overview of personal financial management to our esteemed readers. In subsequent issues we intend bringing out more articles that will benefit an individual, more specifically salaried employees, to plan their personal finances in a constructive and beneficial manner.

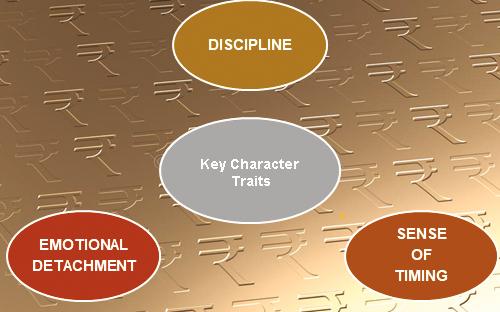

Invariably, at the start of his career a salaried employee is relatively inexperienced about financial management and most of them shy away from it. Little do they realize the detrimental consequences of this on their financial well-being and fulfilling their domestic liabilities and obligations. In simple terms, personal finance covers managing your money through budgeting, saving and investing. Its wide, multiple faceted scope relates to your financial well-being that includes banking, income, expenditure, savings, investment, taxation, safety, and security. The most important aspect of financial planning is identification of your life’s financial goals, which could be higher education, buying a house, planning for retirement, saving for child’s marriage and/or education. The other important aspect is saving and investing to meet these goals. As per the stage in your life cycle, viz. youth, adulthood, middle age, retirement, and old age, certain financial needs arise that drain your financial resources. Financial planning as given in the chart below allows you to consider and plan for these life cycle demands.